1020 EURO OPER UN BITCOIN !!!

NUOVO RECORD

Il rischio di investire in Bitcoin e in Cryptovalute è alto, lo abbiamo ripetuto mille volte. Ma il rischio di NON INVESTIRE IN BITCOIN E IN CRIPTOVALUTE è altrettanto alto.GUARDA COSA TI SEI PERSO IN QUESTI ANNI NEL GRAFICO QUA SOTTO. IN 24 MESI UN RIALZO DEL 450%

PUOI PENSARE CHE E' TROPPO E CHE SOLO UN COGLIONE COMPRA A QUESTI PREZZI..

BENE ...ALLORA VUOL DIRE CHE NON HAI CAPITO L'IMPORTANZA DELLA BLOCKCHAIN.

KING KNOW HA REALIZZATO UN VIDEOCORSO A RIGUARDO (in vendita a 249 euro o 0,2 bitcoin)

E NON HAI CAPITO CHE GLI ASSET MANAGER DEL MONDO ANCORA NON HANNO INZIATO A COMPRARE.

NON HAI CAPITO CHE I 16 MILIARDI DI DOLLARI DI CAPITALIZZAZIONE NON SONO NULLA CONTRO I 40 ENTRO DUE ANNI O I 160 ENTRO 5 ANNI

il rischio e' di essere tagliati fuori da un MONDO NUOVO E DIROMPENTE. Un mondo non solo legato agli investimenti ma sopratutto alla vita e ai lavori di tutti i giorni.

Il bitcoin non è un normale asset come tanti altri...ma è un nuovo modo di concepire i vari business! il concetto di registro pubblico è devastante MA SOLO IN POCHI LO HANNO CAPITO...

ieri mi sono arrivate fra le mani le righe di un analista importante a Lugano che racconta al suo cliente che il Bitcoin non è store of value! che il Bitcoin è pericoloso ! che gli avevano proposto di investire anni fa ma ci crede...INSOMMA UNA SERIE DI CAZZATE ...CHE MI HANNO FATTO SORRIDERE...

SENZA CONTARE CHE IO DUE ANNI FA CON WMO ASSET ALLOCATION HO FATTO L'11,20% E NEL 2016 L'11,32% MENTRE QUESTO GESTORE CON I SUOI CLIENTI PAPERONI.....HA FATTO MOLTO MA MOLTO MENO ...

e per finire...il mio amico (e cliente di questi tizi....) ieri ha tirato fuori informazioni vecchie (che gli ha dato il gestore) pensando che io non le sapessi ...o di cogliermi impreparato.... E ANCORA UNA VOLTA DENTRO DI ME HO CAPITO QUANTA IGNORANZA ESISTE ANCORA (E PER FORTUNA)..

AL MIO AMICO ALLA FINE GLI HO DETTO DI NON INVESTIRE NEL MIO VEICOLO....DI CONTINUARE A FIDARSI DEI SUOI BRAVI GESTORI SVIZZERI E ... ..ANZI..GLI HO PURE CONSIGLIATO UNA ALTERNATIVA DI INVESTIMENTO E COSI' SARA' FELICE ..E MI DISPIACE PER LUI PERCHE' NON HA CAPITO L'IMPORTANZA DELLA BLOCKCHAIN)

IL BITCOIN E' DESTINATO A 2000 DOLLARI E POI 3000 E ANCHE 5000 O 10.000 DOLLARI MA...QUELLO CHE PORTERA' RICCHEZZA NON SARA' UN CAZZUTO ETF SUL BITCOIN ....BENSI' LE ICO E I TOKEN ...monete che incorporano un diritto a un dividendo automatico.

insomma ci saranno token che nei prossimi anni permetteranno di guadangare 100 volte l'investimento inziale...bastera' esserci e avere un tema primario ! NOI LO ABBIAMO!

SIAMO ORAMAI UNA SQUADRA CHE PUO' CONTARE SU UNA CINQUANTINA DI PROFESSIONISTI FRA MILANO E LUGANO. SENZA CONTARE CHE ENTRO 12 MESI SAREMO OLTRE 100 PERSONE GRAZIE ALLA NASCITA DI VENTURES CON ALMENO 4 LABORATORI DI RICERCA SU BLOCKCHAIN E BITCOIN.

Stiamo consegnando in queste ore tutte le informazioni agli amici che vogliono saperne di piu' per COGLIERE UNA OPPORTUNITA' UNICA DI INVESTIMENTO (rischiosissima...si vero..ma forse....con buone probabilita' è molto piu' rischioso NON INVESTIRE )

VENERDI 6 (BEFANA), SABATO 7, DOMENICA 8 SONO A DISPOSIZIONE PER TUTTI COLORO CHE VOGLIONO INFORMARSI E PRENDERE AL VOLO QUESTO TRENO!

MERCATILIBERI@GMAIL.COM

335.6651045

SKYPE : PBARRAI

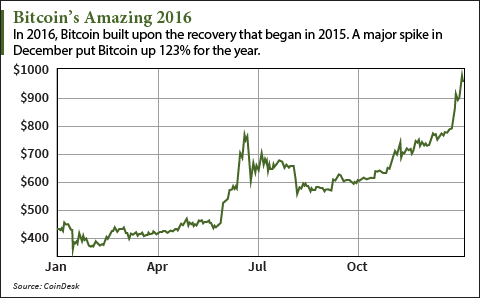

"Why is the Bitcoin price rising past $1,000?" is a question on a lot of lips this week. And for good reason.The cryptocurrency had an astounding run in December, soaring more than 30% from $742 to $968. In the first two days of 2017, the price of Bitcoin is up nearly 6% more, to $1,025 on the CoinDesk Bitcoin Price Index.

That's the highest level for the price of Bitcoin since December 2013, when the digital currency had started its year-long retreat from its all-time high of $1,156.06.

For all of 2016, the Bitcoin price gained 123%, easily outperforming other assets such as stocks (the Standard & Poor's 500 Index rose 9.5%), crude oil (up 45%), and natural gas (up 59%). The closest currency to Bitcoin was the Russian ruble, up 17% against the U.S. dollar.

It's the second year in a row the digital currency has topped all other assets. In 2015 the price of Bitcoin rose 35%.

Even so, the recent surge in the Bitcoin price – particularly December's steep rise – took many by surprise. It's left many searching for an answer about what's driving such aggressive price increases.

Of course, part of the answer is that there isn't just one answer…

Why the Bitcoin Price Has Been Rising So Fast

Multiple factors combined in the second half of 2016 to set Bitcoin up for its current run to $1,000. Such as:

The halving: On July 9, the reward Bitcoin miners get for solving a block was halved by the network from 25 bitcoins to 12.5 bitcoins. The Bitcoin price spiked in June in anticipation of this reduction in supply, then dropped back in late July. But as I pointed out then, the full impact of the last halving (in November 2012) was delayed for several months.

Why Is the Bitcoin Price Rising Past $1,000?

"Why is the Bitcoin price rising past $1,000?" is a question on a lot of lips this week. And for good reason.The cryptocurrency had an astounding run in December, soaring more than 30% from $742 to $968. In the first two days of 2017, the price of Bitcoin is up nearly 6% more, to $1,025 on the CoinDesk Bitcoin Price Index.

That's the highest level for the price of Bitcoin since December 2013, when the digital currency had started its year-long retreat from its all-time high of $1,156.06.

For all of 2016, the Bitcoin price gained 123%, easily outperforming other assets such as stocks (the Standard & Poor's 500 Index rose 9.5%), crude oil (up 45%), and natural gas (up 59%). The closest currency to Bitcoin was the Russian ruble, up 17% against the U.S. dollar.

It's the second year in a row the digital currency has topped all other assets. In 2015 the price of Bitcoin rose 35%.

Even so, the recent surge in the Bitcoin price – particularly December's steep rise – took many by surprise. It's left many searching for an answer about what's driving such aggressive price increases.

Of course, part of the answer is that there isn't just one answer…

Why the Bitcoin Price Has Been Rising So Fast

Multiple factors combined in the second half of 2016 to set Bitcoin up for its current run to $1,000. Such as:

The halving: On July 9, the reward Bitcoin miners get for solving a block was halved by the network from 25 bitcoins to 12.5 bitcoins. The Bitcoin price spiked in June in anticipation of this reduction in supply, then dropped back in late July. But as I pointed out then, the full impact of the last halving (in November 2012) was delayed for several months.

global currency worries: As fiat currencies have shown increasing fragility, a digital currency like Bitcoin has grown more attractive. Both South Sudan and Venezuela had 2016 inflation rates of about 475%. People also worried about the global war on cash, with India invalidating 86% of its banknotes in circulation virtually overnight.

Political Uncertainties: The Brexit vote, the increasing frequency of terrorist attacks, and the rise of nationalism worldwide have all contributed to an uneasy feeling among investors. In such times people look for safe havens, and in 2016 Bitcoin joined gold and silver as a safe haven

Big Banks Embracing Blockchain: Although venture capital investment in Bitcoin slowed in 2016, financial institutions continued to move ahead in their efforts to adopt Bitcoin's blockchain technology to suit their own purposes. That validation has helped reassure those on the fence about investing in Bitcoin while encouraging more industries to consider how they might benefit from digital currencies.

Now with all that as a backdrop, add one more incredibly potent ingredient:

Political Uncertainties: The Brexit vote, the increasing frequency of terrorist attacks, and the rise of nationalism worldwide have all contributed to an uneasy feeling among investors. In such times people look for safe havens, and in 2016 Bitcoin joined gold and silver as a safe haven

Big Banks Embracing Blockchain: Although venture capital investment in Bitcoin slowed in 2016, financial institutions continued to move ahead in their efforts to adopt Bitcoin's blockchain technology to suit their own purposes. That validation has helped reassure those on the fence about investing in Bitcoin while encouraging more industries to consider how they might benefit from digital currencies.

Now with all that as a backdrop, add one more incredibly potent ingredient:

China.

How China Has Fueled the Rise in the Price of Bitcoin In general the rise in the price of Bitcoin in 2016 has mirrored the decline in the value of the Chinese yuan. China's influence over what happens with Bitcoin has grown dramatically over the past several years. Most of the Bitcoin miners are located there. And more than 90% of Bitcoin trading by volume takes place on the Chinese Bitcoin exchanges, although those numbers are thought to be inflated.

One the reasons Bitcoin has grown popular in China is that it offers a haven from the falling yuan. Chinese businessmen and middle-class citizens see Bitcoin as one of the few options they have to preserve their wealth.

Some Chinese are also likely using Bitcoin to skirt that nation's capital controls. And that monthly rate at which capital is leaving China continues to accelerate. In August, about $27.7 billion worth of yuan left China. In September, that number rose to $44.7 billion. In November it was $69.2 billion.

The Chinese are concerned about further yuan devaluations as well as increased tightening of capital controls.

Just last Friday the People's Bank of China (PBOC) announced that the threshold for Chinese banks to report yuan-denominated cash transactions will drop from 200,000 yuan to just 50,000 yuan (about $7,200).

This is why the Bitcoin price in yuan has been tracking higher than its price in U.S. dollars lately. Today (Monday) Bitcoin has been trading at about 7,320 yuan – the equivalent of $1,053.

Fears of what the PBOC will do next will keep worried Chinese buying Bitcoin, which in turn will maintain upward pressure on the price of Bitcoin, at least in the short term.

But what does 2017 hold in store for Bitcoin? Here's what some top Bitcoin influencers recently told Money Morning…

Where the Bitcoin Price Is Headed in 2017

Nearly every expert we talked to in December foresaw more Bitcoin adoption in 2017, which is a primary long-term catalyst for the Bitcoin price. Many also saw further woes for fiat currencies driving more people to Bitcoin.

"Micropayment models will start to gain traction, and Bitcoin will increasingly become a global currency risk hedge as currency wars flame up. India opened up a can of worms, and other countries will follow their example of a war on cash," said Alan Silbert, founder and CEO of BitPremier.

Although their forecasts for the price of Bitcoin in 2017 vary widely, all believe it will end the year significantly higher.

For example, Silbert predicted a Bitcoin price of $1,450 (Bitcoin was trading below $900 at the time). The most optimistic expert was Tim Draper, founding partner of the Draper Fisher Jurvetson (DFJ) venture capital firm and best known for buying up all 30,000 bitcoins in the June 2014 auction of confiscated Silk Road bitcoins. He forecasts a price of $10,000.

But most eyes are now focused on Vinny Lingham, who has drawn attention for several spot-on Bitcoin price predictions. Lingham, a Bitcoin Foundation board member, said in May that Bitcoin would hit $1,000 by the end of 2016. He was off by less than 24 hours.

"Just figured out why I was out by a day on my $1k Bitcoin prediction… 2016 was a leap year – I forgot to factor in that extra day!" Lingham joked on Twitter.

Lingham also predicted Bitcoin's 2013 run to $1,000 when it was trading at just over $100. In 2014 he warned that the Bitcoin price would languish through a long period of consolidation below $550.

For 2017, this "Bitcoin Oracle" sees the big gains continuing."I think it could break $3,000 during the year and maybe settle in the $2,000-plus zone," Lingham said.

securities and Exchange Commission is likely to approve the Winklevoss Bitcoin Trust (BATS: COIN), an exchange-traded fund based on Bitcoin, in the first half of 2017. A Bitcoin ETF will make it much easier to invest in the digital currency, but as this ETF will break new ground, investors will have a lot of questions.

How China Has Fueled the Rise in the Price of Bitcoin In general the rise in the price of Bitcoin in 2016 has mirrored the decline in the value of the Chinese yuan. China's influence over what happens with Bitcoin has grown dramatically over the past several years. Most of the Bitcoin miners are located there. And more than 90% of Bitcoin trading by volume takes place on the Chinese Bitcoin exchanges, although those numbers are thought to be inflated.

One the reasons Bitcoin has grown popular in China is that it offers a haven from the falling yuan. Chinese businessmen and middle-class citizens see Bitcoin as one of the few options they have to preserve their wealth.

Some Chinese are also likely using Bitcoin to skirt that nation's capital controls. And that monthly rate at which capital is leaving China continues to accelerate. In August, about $27.7 billion worth of yuan left China. In September, that number rose to $44.7 billion. In November it was $69.2 billion.

The Chinese are concerned about further yuan devaluations as well as increased tightening of capital controls.

Just last Friday the People's Bank of China (PBOC) announced that the threshold for Chinese banks to report yuan-denominated cash transactions will drop from 200,000 yuan to just 50,000 yuan (about $7,200).

This is why the Bitcoin price in yuan has been tracking higher than its price in U.S. dollars lately. Today (Monday) Bitcoin has been trading at about 7,320 yuan – the equivalent of $1,053.

Fears of what the PBOC will do next will keep worried Chinese buying Bitcoin, which in turn will maintain upward pressure on the price of Bitcoin, at least in the short term.

But what does 2017 hold in store for Bitcoin? Here's what some top Bitcoin influencers recently told Money Morning…

Where the Bitcoin Price Is Headed in 2017

Nearly every expert we talked to in December foresaw more Bitcoin adoption in 2017, which is a primary long-term catalyst for the Bitcoin price. Many also saw further woes for fiat currencies driving more people to Bitcoin.

"Micropayment models will start to gain traction, and Bitcoin will increasingly become a global currency risk hedge as currency wars flame up. India opened up a can of worms, and other countries will follow their example of a war on cash," said Alan Silbert, founder and CEO of BitPremier.

Although their forecasts for the price of Bitcoin in 2017 vary widely, all believe it will end the year significantly higher.

For example, Silbert predicted a Bitcoin price of $1,450 (Bitcoin was trading below $900 at the time). The most optimistic expert was Tim Draper, founding partner of the Draper Fisher Jurvetson (DFJ) venture capital firm and best known for buying up all 30,000 bitcoins in the June 2014 auction of confiscated Silk Road bitcoins. He forecasts a price of $10,000.

But most eyes are now focused on Vinny Lingham, who has drawn attention for several spot-on Bitcoin price predictions. Lingham, a Bitcoin Foundation board member, said in May that Bitcoin would hit $1,000 by the end of 2016. He was off by less than 24 hours.

"Just figured out why I was out by a day on my $1k Bitcoin prediction… 2016 was a leap year – I forgot to factor in that extra day!" Lingham joked on Twitter.

Lingham also predicted Bitcoin's 2013 run to $1,000 when it was trading at just over $100. In 2014 he warned that the Bitcoin price would languish through a long period of consolidation below $550.

For 2017, this "Bitcoin Oracle" sees the big gains continuing."I think it could break $3,000 during the year and maybe settle in the $2,000-plus zone," Lingham said.

securities and Exchange Commission is likely to approve the Winklevoss Bitcoin Trust (BATS: COIN), an exchange-traded fund based on Bitcoin, in the first half of 2017. A Bitcoin ETF will make it much easier to invest in the digital currency, but as this ETF will break new ground, investors will have a lot of questions.

No comments:

Post a Comment